Choosing the Right Term For Your Mortgage

Blog:Choosing the Right Term For Your Mortgage

Posted on

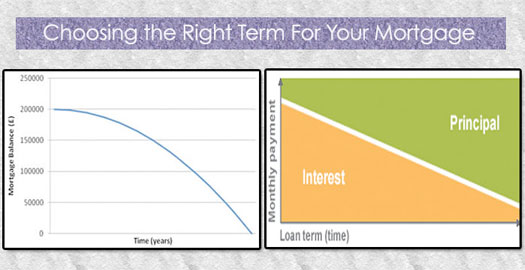

Your mortgage loan officer or financial planner will tell you that saving the amount of mortgage interest paid to a lender over time is a critical component of your financial future. Initially, that means getting the lowest mortgage rate possible. A lower mortgage rate will lower your payment with less interest. Yet another important factor is just as important as the interest rate on your loan—the loan term.

Easily the most popular loan term in today’s market is the 30 year mortgage. This term offers low rates as well as the lowest monthly payment over the life of the loan. Yet because the loan is spread out over 30 years, that interest begins to pile up. To counter this long term interest, borrowers look to the 15 year loan. The mortgage interest rates on 15 year loans are lower compared to the 30 year program but the monthly payments are much higher. How much so? Let’s look at a $300,000 mortgage using a 3.75% interest rate on a 30 year fixed rate product, and a 3.50% interest rate on a 15 year fixed rate product:

Mortgage Product Comparison

| Term | Payment |

|---|---|

| 30 Years | $1,389 |

| 15 Years | $2,181 |

Over the course of each loan, how much interest is paid to the lender?

Interest Payments Made Over Life Of Loan

| Term | Interest Paid |

|---|---|

| 30 Years | $200,040 |

| 15 Years | $92,580 |

Okay, so which is the better option? Obviously, if saving interest paid to the lender is a factor the 15 year loan is the choice, saving more than $100,000 in interest. Yet the monthly payments on the 15 year note are so much higher than the 30 year fare, making the 15 year so much harder in which to qualify. But even though consumers routinely see advertisements for a 30 or 15 year rate, there are other choices. Choices that some loan officers aren’t even aware of.

Even though they’re not heavily marketed, lenders offer loan terms in five year increments from 10 to 30 years. That means in addition to a 30 and 15 year loan, there are also 10, 20 and even 25 years. The rates will vary slightly with the shorter terms having slightly lower rates. If a 30 year rate is available at 3.75%, a 25 year note will have a similar rate at 3.75%. A 20 year might be at 3.375% and a 10 year closer to the 15 year rate of 3.50. Using the same $300,000 loan, here are the monthly payments and long term interest for the remaining three terms:

Additional Mortgage Product Term Comparisons

| Term | Payment | Interest paid |

|---|---|---|

| 10 Years | $2,966 | $55,920 |

| 20 Years | $1,720 | $162,600 |

| 25 Years | $1,542 | $162,600 |

You can easily see that the shorter the term, the higher the mortgage payment. Yet the shorter the term also results in much less mortgage interest paid to the lender. Note that these mortgage rates are for comparative purposes and rates can change daily but they provide a clear example on the impact of a loan term.

If you want to pay as little mortgage interest as possible and still keep a handle on monthly payments, there are more options beyond the traditional 15 and 30 year mortgage loans. It’s possible to strike a balance between a comfortable mortgage payment and long term interest.

Let one of our New York or New Jersey Mortgage offices help you with any question you may have concerning your mortgage options. Our licensed Loan Officers are trained to assist you with any of your mortgage loan needs. NJ Lenders is a leading mortgage lender in the states of NJ, NY, CT, PA, VA, MD, and FL.